Please choose a body region on the right for you to pin point the problem area of your body.

Shop by Condition

Shop by Brand

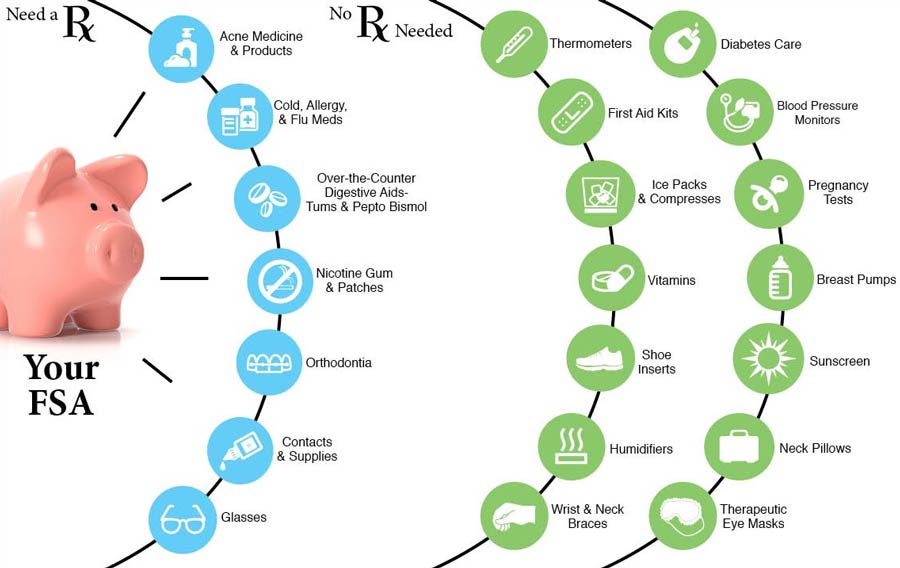

It is likely that you have heard the term FSA tossed around in medical offices, pharmacies, or even in HR departments when onboarding for new employment. Many people, however, don’t know what an FSA is. We are here to break down the confusion barriers and explain all about FSA Flexible Spending Accounts. What is an FSA? An FSA (Flexible Spending Account) is a special account into which individuals put money to use for certain out-of-pocket healthcare expenses. FSAs are tax-exempt, meaning you will not pay taxes on this money. The amount of money one can contribute to an FSA is limited to $2,750 per person per year per employer. FSAs can be used to pay for medical and dental expenses for an individual, their spouse (if they are married), and their dependents (if they have any).

FSAs can be used to cover certain medical and dental expenses. These include prescription medications, deductibles, copays, and medical equipment such as crutches, canes, bandages, and certain diagnostic devices. It is important to note that FSA funds cannot be used to pay for insurance premiums.

There are many reasons having a Flexible Spending Account may be useful for you, your spouse, or one of your dependents. FSAs help pay for items you may already be purchasing by allocating untaxed money towards this specific use. Tax-free purchases with health care FSA funds can help save hundreds of dollars on prescriptions, doctor’s office copays, health insurance deductibles, medical equipment, and more. What is Covered Under an FSA? As long as your employer offers it, it is recommended that everyone enroll in a Flexible Spending Account program. FSAs cover a broad range of conditions and medical expenses, making it worthwhile for almost anyone to participate. Just some FSA eligible items include:

Both FSAs and HSAs are put into place so people can set aside tax-free money to pay for medical expenses. Some people have confusion about the difference between an FSA and an HAS. An HSA or a health savings account is controlled by the individual. HSAs allow contributions to rollover, making them more flexible than FSAs. FSAs are less flexible than HSAs and are owned by the employer. This means that people who leave their jobs do not get to keep any funds that they contributed to their FSAs during their employment. They do, however, get to keep HAS funds and roll them over into other health savings accounts.

If your employer offers an FSA, it is a great idea to set aside money and put it towards this flexible spending account. Find out more about FSA eligible medical devices and more when you visit CWI Medical today!

| |

|---|

Pro Advantage 25 Person First Aid Kit |

Pure Expressions Dual Channel Electric Breast Pump |

| |

|---|

Safetec Sunscreen Lotion |

Nitro Aluminum Rollator with 10 inch Casters |

Advantage Ultra Automatic Digital Blood Pressure Monitor |

| Stay Connected! | |

|

|

|

Related Articles

Get $10 off your next order when you sign up to receive our email newsletter.*

Simply enter your email address below!

*Minimum order value of $100. Valid email address to qualify.